California Property Damage Claims After a Car Crash

Published on / Category: California Driving Laws, Insurance & Claims

A car accident can upend your day in seconds. But the stress doesn’t stop once the dust settles—it often grows as you try to get your vehicle repaired, deal with insurance adjusters, and figure out who’s responsible for the damage.

Whether your car has a dented door, a cracked windshield, or has been completely totaled, knowing how to file a property damage claim is key to getting the compensation you deserve.

This guide walks you through the process of filing a car accident property damage claim in California, from what’s covered and who pays to when you might need legal help. If you’re dealing with confusing paperwork, unfair settlement offers, or a stalled claim, you’re not alone—and there’s help available.

At a Glance:

If your car was damaged in a crash, you may be entitled to compensation through a property damage claim. This can cover repairs, total loss settlements, towing, storage, and damaged personal items. In California, the at-fault driver’s insurance usually pays—but only if fault is clear and coverage is adequate. Prestige Law Firm P.C. can help you recover what you’re owed. We offer free consultations and charge nothing unless we win.

What is a property damage claim?

A property damage claim is a formal request for payment after your belongings are damaged in a car accident. Most commonly, this refers to your vehicle—but it can also include items inside the car or nearby property that was hit during the crash.

These claims help cover the cost of repairs or the replacement value of your vehicle if it’s considered a total loss. Depending on the coverage, you may also be reimbursed for towing, storage, and even a rental car.

Property damage claims are different from personal injury claims. They only deal with physical items—like your car or phone—not injuries or medical care. In many accidents, you may file both types of claims, but they are handled separately.

Timing is important. Insurance companies often have strict deadlines, and waiting too long could weaken your claim. Reporting the damage quickly and documenting everything early will give you the best chance of receiving full compensation.

What property damage can you claim after an accident?

After a crash, property damage can go beyond dents and broken glass. A thorough claim should account for all losses connected to the incident—not just damage to your car.

Here are common types of property damage you may be entitled to claim:

1. Vehicle Repairs

If your car can be fixed, you can claim the cost of all necessary repairs. This includes mechanical work, paint, and body shop property damage repairs needed to restore the vehicle to pre-accident condition.

2. Replacement Costs (Total Loss)

If repairs cost more than the car’s value, it may be declared a total loss. You’re then entitled to the vehicle’s fair market value before the accident, based on age, mileage, and condition.

3. Personal Belongings Inside the Vehicle

Phones, laptops, tools, or any other personal property damaged in the crash may be included in your claim. Be sure to document each item and prove it was inside the vehicle during the collision.

4. Towing and Storage Fees

If your car was towed or kept in a lot after the accident, those fees are typically recoverable—especially if the car was impounded for inspection or repair estimates.

5. Appraisal and Inspection Costs

If you needed an independent mechanic or appraiser to assess damage or challenge a low insurance offer, those costs may be reimbursed as part of your claim.

6. Public or Private Property Damage

If the accident damaged other people’s property—like a fence, mailbox, or commercial sign—you may be responsible. On the other hand, if your property was damaged, you can include it in your claim.

Each of these losses can be financially significant. Filing a complete claim backed by photos, receipts, and documentation helps ensure you aren’t left covering costs that should be paid by insurance.

Who Pays for the Damage?

In most California car accidents, the at-fault driver’s insurance is responsible for covering property damage. But that depends on several key factors, including who caused the crash, what kind of insurance policies apply, and whether the driver has valid coverage.

Let’s break it down step by step.

Determining Fault

California is a fault-based state, meaning whoever caused the crash is generally financially liable.

Under California Civil Code § 1714, every person is responsible for damages resulting from their lack of ordinary care. That means if another driver caused your accident—by texting, speeding, or running a red light—their insurance should cover your vehicle repair or replacement.

Fault is determined using police reports, photos, surveillance footage, and witness statements. If the other driver tries to deny liability or blame you, having clear documentation and a car accident lawyer can help protect your rights.

Insurance Coverages That May Apply

Depending on the situation, several types of car insurance may help cover your losses. These include:

Liability Insurance

Covers damage the at-fault driver causes to your car or other property. It’s required in California and includes property damage and bodily injury components. This is usually your first route to compensation if you weren’t at fault.

Collision Coverage

Optional, but useful if you’re at fault or if the other driver is uninsured. It covers repairs or replacement of your own vehicle—regardless of who caused the crash.

Uninsured/Underinsured Motorist Property Damage (UMPD)

If the at-fault driver doesn’t have insurance or doesn’t have enough to cover the damage, UMPD may kick in. This is especially important for hit-and-runs. Check your policy, as not all drivers carry this coverage.

Comprehensive Coverage

Covers non-collision events like theft, vandalism, falling trees, or weather damage. Not always relevant to a traffic accident—but useful if you’re unsure what caused the damage or if other factors are involved.

If the At-Fault Driver Is Uninsured

If the driver who hit you has no insurance, you still have options—but they depend on your policy.

- If you have collision coverage, you can use it to pay for repairs while your insurer pursues reimbursement (subrogation).

- If you have UMPD, it may cover your vehicle damage.

- You may also sue the at-fault driver, but collecting compensation can be difficult if they have no assets.

In hit-and-run cases, UMPD or collision coverage is often your best bet.

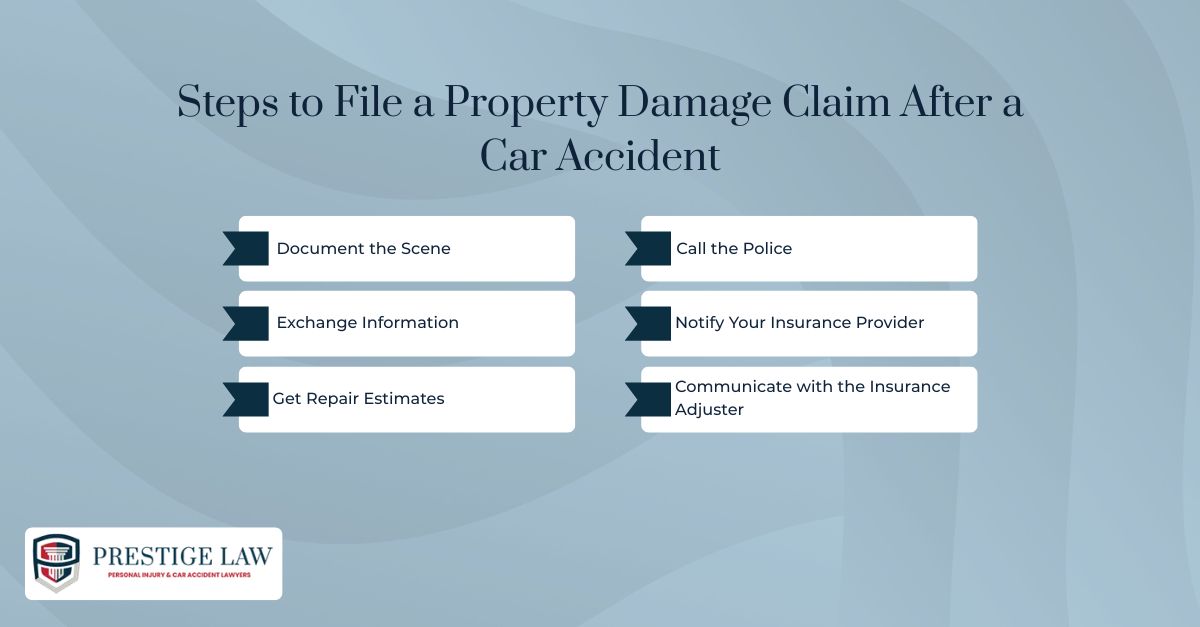

How do I file a property damage claim?

Filing a car accident property damage claim doesn’t have to be confusing—but timing and documentation are everything. The earlier you act, the smoother the process.

Follow these steps to protect your rights and get compensated:

1. Document the Scene

Before vehicles are moved or towed, take photos of:

- All vehicles involved (from different angles)

- Visible damage to each car

- Skid marks, broken glass, and surrounding areas

- Road signs, intersections, or signals nearby

Visual proof helps establish fault and supports your claim.

2. Call the Police

In California, you must report a crash if there are injuries, death, or significant damage. Even if the accident seems minor, having an official police report strengthens your case.

If police don’t respond, file a report at your local station or complete the DMV SR-1 form online.

3. Exchange Information

- Get the following from the other driver:

- Full name and contact details

- Driver’s license and plate number

- Insurance company and policy number

- Vehicle make, model, and colour

- Registration details

Also collect contact info from any witnesses.

4. Notify Your Insurance Provider

Even if you’re not at fault, inform your own insurer. Most policies require prompt notice to remain valid.

You may also qualify for rental coverage, towing reimbursement, or help with repair shops—especially if there are delays with the other driver’s insurer.

5. Get Repair Estimates

You can choose your own repair shop—the insurer cannot force you to use their preferred location. Get at least one written estimate (ideally two) so you can compare pricing and ensure fair compensation.

Some insurers may also send an adjuster to inspect your car or ask you to visit a certified assessment site.

6. Communicate with the Insurance Adjuster

Once your claim is open, an adjuster will evaluate the damage and make an offer. To protect yourself:

- Stick to facts only

- Avoid saying you’re “fine” or admitting fault

- Ask for all offers in writing

- Keep a written record of every conversation

If things stall, or the offer seems too low, a car accident attorney can help push back and protect your interests.

Let Prestige Law Firm P.C. Help With Your Property Damage Claim

Struggling with a stalled insurance claim, low repair estimates, or unclear next steps after a car accident? You don’t have to deal with it alone.

At Prestige Law Firm P.C., we help accident victims across California — especially in Van Nuys, Palmdale, and Los Angeles County — recover the compensation they’re owed after vehicle damage. Our legal team is here to move your case forward quickly and protect your rights throughout the process.

Led by attorney Paul Aghabala, our boutique firm brings over two decades of hands-on experience in serious car accident cases to show them how a car accident attorney can really help. We handle the legal and insurance headaches so you can focus on getting your vehicle repaired, your rental car covered, and your life back on track.

What sets us apart:

✅ No upfront fees — you only pay if we win

✅ Fast support for vehicle repairs, rental access, and replacement

✅ Direct communication with your attorney, not junior staff

✅ Aggressive negotiation to secure the compensation you truly deserve

Call (818) 788-0808 or (661) 341-3939 today for a free consultation and immediate support.

Conclusion

Dealing with property damage after a car accident can be frustrating. Between repair bills, storage fees, insurance calls, and delays, it’s easy to feel overwhelmed — especially if you’re still shaken from the crash itself.

But you don’t have to go through it alone.

At Prestige Law Firm P.C., we help California drivers get their cars repaired, their property replaced, and their claims handled fairly. Whether you’re battling lowball offers or trying to figure out who pays, we’re here to make the process smoother, faster, and less stressful.

Can I sue for property damage in a car accident?

Yes. If the at-fault driver or their insurer won’t pay fairly, you can file a civil lawsuit or go to small claims court.

How long does it take to settle a property damage claim?

Simple claims can resolve in weeks. Disputed or complex ones may take a few months.

Do I need a lawyer for a car property damage claim?

Not always. But if your claim is delayed, denied, or undervalued, a lawyer can help protect your rights.

What if the insurance company offers too little for my car?

You can dispute the amount, submit your own estimates, or hire a lawyer to negotiate or file suit.

Get Started Today!

24 hours a day / 7 days a week / 365 days a year

Contact our Los Angles and Antelope team of attorneys for a free consultation.