Can You Sue Someone with No Money in California?

Published on / Category: Legal Rights & Process

Someone wrecked your car, broke a contract, or caused serious injury—and now you’re left with the damage. You deserve justice. But what if the person at fault has no money to pay?

In California, you can still file a lawsuit. The court may rule in your favor. But enforcing that judgment is another matter entirely.

This guide breaks down what it means to sue someone who’s “judgment proof,” how enforcement works under California law, and when it might be worth pursuing a claim.

If you’re considering legal action, it’s critical to work with the best personal injury attorney to protect your rights and strategy from day one.

At a Glance:

You can sue someone even if they have no money, but collecting payment is often difficult. In California, a court judgment lasts 10 years and can be renewed. Legal tools like wage garnishment, property liens, and bank levies may help, but many assets are protected. Suing may still be worthwhile for future collection, accountability, or legal closure—if you know the risks. Get legal advice to decide if it’s the right move.

Can you sue someone who has no money?

Yes, you can. In California, a person’s financial status does not remove their legal responsibility. If someone harms you, breaks a contract, or causes financial loss, you have the right to take legal action—regardless of whether they can pay.

A successful lawsuit means the court agrees that the other party is liable. But if that person has no assets or income, collecting the money you’re owed can be a challenge.

People in this situation are often called “judgment proof.” It means they owe you, but the law protects their income or they simply don’t have anything you can collect from.

That doesn’t make the lawsuit pointless. A court judgment still has legal value. It confirms the debt, may influence the defendant’s future behavior, and leaves the door open for collection if their finances improve.

Before filing, weigh the possible outcome. In the next section, we’ll walk through how California law lets you enforce a judgment—and how our process helps you assess if it’s the right path.

How do you enforce a judgment when the defendant has no money?

Winning a lawsuit is just the first step. The harder part is collecting what you’re owed—especially if the person you sued has no money now.

In California, a court judgment gives you legal tools to try and recover that debt. Some of these methods can be used immediately, while others may work better down the line if the defendant’s financial situation improves.

But there are limits. California law protects certain income, property, and bank funds from collection—especially for people with low or no income. That’s why it’s important to know which enforcement options make sense in your case.

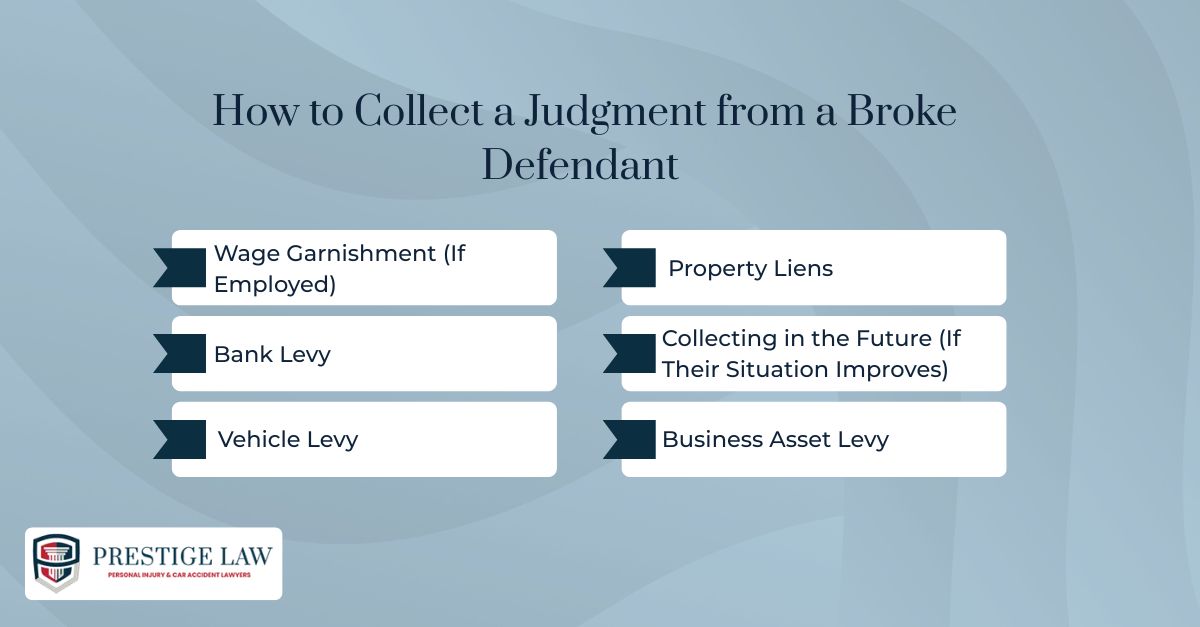

Here are the most common judgment enforcement tools and how they work:

Wage Garnishment (If Employed)

If the defendant has a job, you may ask the court for an earnings withholding order. Under CCP § 706.050, the garnishable amount is limited to the lesser of:

- 20% of their disposable income, or

- 40% of everything earned beyond 48 times the applicable minimum wage .

These calculations apply weekly or can be prorated if they’re paid bi‑weekly, semi‑monthly, or monthly. This ensures the person still has enough money for basic living expenses.

Property Liens

If the person you sued owns real estate, you can place a lien on their property by recording an abstract of judgment. Under CCP § 697.310, this lien prevents them from selling or refinancing without first addressing the debt.

While this won’t lead to immediate payment, it puts pressure on the debtor over time—especially if property values increase or they need to refinance.

However, California law does protect equity in a primary residence. Under CCP § 704.730, a certain portion of home equity is exempt from collection, depending on the debtor’s circumstances. This can reduce or eliminate what you’re able to recover from the sale of a property.

Bank Levy

If the defendant has a bank account, you may be able to seize funds through a court-ordered writ of execution. This authorizes the sheriff to serve the financial institution and freeze available funds.

Under California Code of Civil Procedure § 700.140, this method can be used to collect part or all of a court judgment—provided the funds are not legally exempt.

But there are limitations. Public benefits, child support payments, and a portion of wages are typically protected under both state and federal law. California law (CCP § 704.080) also exempts a percentage of recent wage deposits from seizure.

So even if you locate the person’s account, much of the money inside may be off-limits. The success of a bank levy depends on timing, accuracy, and whether the account holds eligible, non-exempt funds.

Collecting in the Future (If Their Situation Improves)

Someone who is “judgment proof” today may not stay that way forever. Financial situations change. A person might get a better-paying job, receive an inheritance, buy property, or open a business down the line.

The good news is that a court judgment in California remains valid for 10 years, and it can be renewed before it expires. That gives you time to act when it counts.

Even if collection isn’t possible right now, a judgment positions you to maximize your recovery later—when the defendant’s circumstances improve and enforcement becomes more effective.

Vehicle Levy

If the person you sued owns a vehicle outright, you may be able to recover part of the judgment through a vehicle levy. This involves asking the court for a writ of execution, which authorizes the sheriff to seize and sell the vehicle.

To move forward, you’ll need to provide accurate details—make, model, VIN number, and the vehicle’s location. The car must be registered solely in the defendant’s name and not already under loan or lien.

Keep in mind: California exemptions may protect a portion of the vehicle’s value, especially if it’s essential for commuting to work. The amount you recover will depend on the vehicle’s equity and whether any portion is shielded by law.

Business Asset Levy

If the judgment debtor owns a business, you have additional tools to collect. One common method is a till tap, where a sheriff collects money directly from the cash register during business hours.

Another is a keeper levy, in which the sheriff stays on the premises—often for several hours or days—to collect incoming revenue or inventory sales.

These methods are most effective with small, retail, or cash-based businesses. Like other enforcement strategies, they require current and accurate information about the business’s operations and profitability. If the business is barely surviving or has little cash flow, a levy may not be worth the cost.

How long do you have to enforce a judgment?

In California, a money judgment is enforceable for 10 years from the date it’s entered by the court. During this period, you can use tools like wage garnishment, property liens, bank levies, or asset seizure—if the debtor has qualifying income or property.

But what if you’re still unpaid when the 10 years run out?

That’s where renewal comes in. California law allows you to renew the judgment before it expires. If you don’t file for renewal in time, the judgment becomes unenforceable, and you lose the right to collect.

Renewing a judgment involves:

- Filing an Application for and Renewal of Judgment (Form EJ-190)

- Paying the required court fee

- Giving proper notice to the debtor

Once renewed, the judgment is valid for another 10 years. The renewal can also include post-judgment costs and interest, increasing the total amount owed and raising the pressure on the debtor to pay.

At Prestige Law, we help clients track judgment deadlines, handle renewals properly, and keep enforcement options open—even years after a lawsuit ends.

Is it worth suing a broke person? Pros and Cons

Before deciding to sue someone who has no money, it’s important to think about both the potential benefits and the drawbacks. A lawsuit can bring justice—but it can also cost time, money, and energy, especially when collection is uncertain.

If you’re unsure whether pursuing a claim is worthwhile, consulting a personal injury attorney in Van Nuys can help you evaluate your case, understand potential recovery options, and avoid wasting resources on a judgment that may be hard to collect.

Let’s take a closer look at both sides.

Let’s take a closer look at both sides.

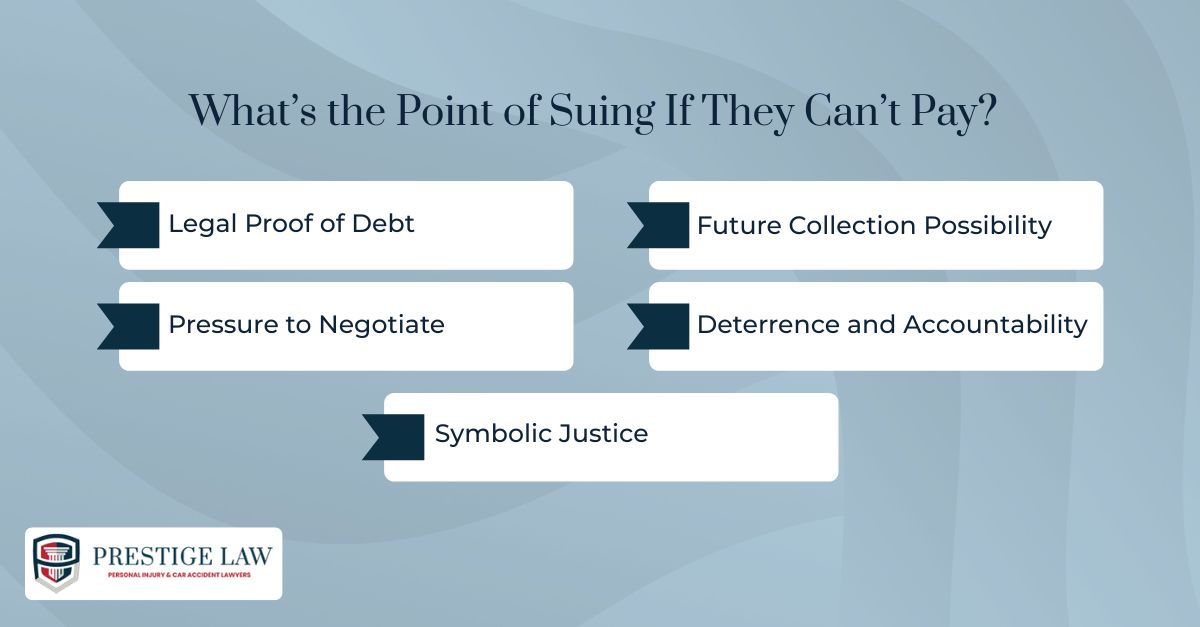

Pros: Why Suing Someone with No Money Might Still Be Worth It

Even if the defendant can’t pay you now, a lawsuit can create long-term leverage and accountability. These advantages may justify taking legal action—especially if you’re dealing with serious harm or misconduct.

Legal Proof of Debt

Winning your case gives you a court-backed judgment that confirms the debt exists. This can offer closure and serve as a critical tool if the person’s financial situation improves later.

Future Collection Possibility

The judgment stays valid for 10 years and can be renewed. That gives you time. If the debtor gets a job, buys property, or receives an inheritance, you’ll be in a legal position to collect.

Pressure to Negotiate

A formal lawsuit may motivate the defendant to settle, set up a payment plan, or reach a compromise—even if they initially claimed they had nothing.

Deterrence and Accountability

Sometimes it’s about more than money. Taking legal action can stop repeat behaviour, especially in cases involving fraud, property damage, or negligence.

Symbolic Justice

Even if the judgment isn’t collected right away, it sends a message: wrongful actions have consequences. For many, that sense of accountability matters.

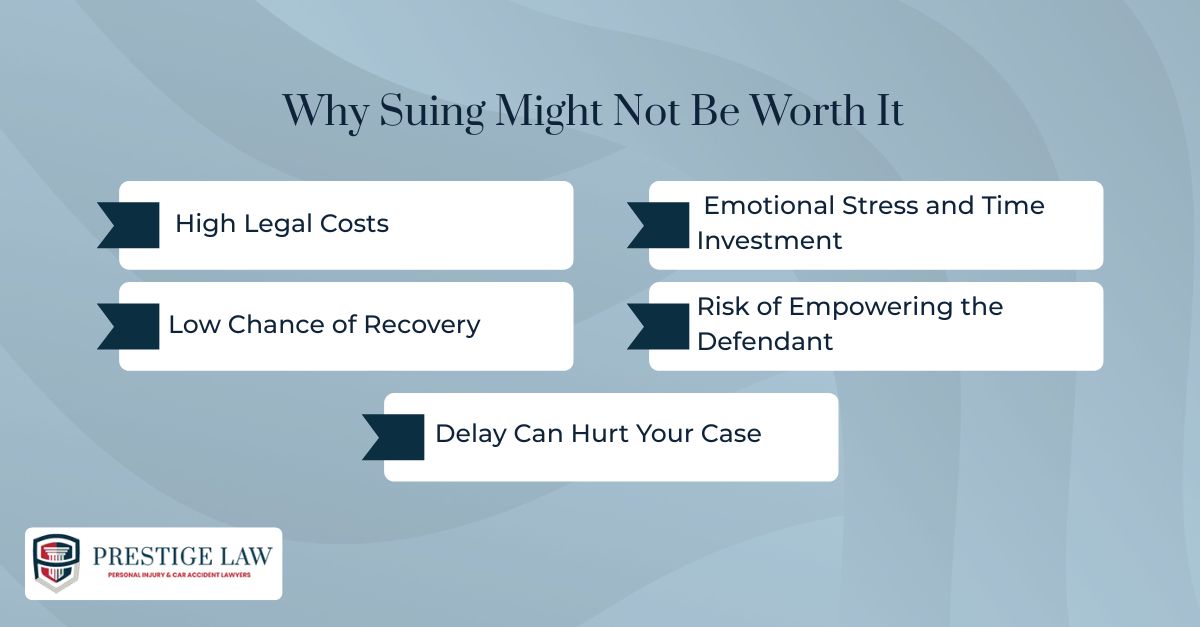

Cons: The Risks and Drawbacks of Suing a Defendant with No Money

While the legal system offers tools to enforce a judgment, that doesn’t mean it’s always worth pursuing. Consider these practical risks before moving forward.

High Legal Costs

Filing fees, court costs, and attorney time can add up. And if the person can’t pay, those costs may come out of your own pocket—especially in smaller cases not taken on contingency.

Emotional Stress and Time Investment

Legal proceedings can stretch out for months or years. The stress of paperwork, delays, and uncertainty can take a toll.

Low Chance of Recovery

If the debtor truly has no assets, your judgment may sit uncollected indefinitely. And exemptions in California can make many of their assets legally untouchable.

Risk of Empowering the Defendant

Some defendants simply don’t care. If they know they’re judgment proof, they might ignore the process or even use delay tactics—knowing you can’t collect.

Delay Can Hurt Your Case

If you wait too long to file, you could miss the statute of limitations. In California, deadlines vary based on the type of claim—whether it’s for personal injury, contract breach, or fraud.

Don’t Just Win in Court, Make It Count with Prestige Law

You’ve suffered losses. Your car is damaged. You’re in pain. And the person responsible doesn’t have the money to make things right.

That doesn’t mean you’re out of options.

At Prestige Law, we believe justice isn’t just about the verdict—it’s about what happens after. With over 23 years of experience handling serious injury cases across California, attorney Paul Aghabala and his team are committed to making every win matter.

We handle cases involving:

✔ Car accidents and property damage

✔ Construction injuries and traumatic brain injuries

✔ Catastrophic work-related incidents

When you work with us, you’ll communicate directly with your attorney—not just staff. We pursue cases aggressively and are prepared to go to trial when necessary. Whether you’re in Van Nuys, Palmdale, or elsewhere in Los Angeles County, we help you navigate the law, protect your rights, and position your case for long-term success.

If your situation involves a serious collision, working with an experienced car accident lawyer in Palmdale can make all the difference. From handling uninsured or underinsured drivers to pursuing compensation for medical bills and property damage, our team has the local knowledge and trial experience to fight for you.

Think a defendant has no assets? Let’s assess the situation together. With the right legal strategy, even a difficult case can lead to future compensation or a meaningful outcome.

Call us today at (818) 788‑0808 or (661) 341‑3939 for a free consultation, or email paul@prestigelaw.com to discuss your case confidentially.

Conclusion

Suing someone with no money isn’t always about getting paid right away. Sometimes, it’s about proving a point, creating long-term leverage, or protecting your rights in a difficult situation.

In California, a judgment gives you legal power that can last for years—and potentially grow in value if the debtor’s financial situation changes. But lawsuits also come with real costs, delays, and emotional weight.

The key is knowing when legal action makes sense and having a strategy that goes beyond the verdict.

At Prestige Law, we help clients think ahead—not just about winning, but about collecting, recovering, and getting closure. If you’re unsure what to do next, we’re here to guide you.

What does it mean to be “judgment proof”?

It means the person owes money but has no income or assets that can be legally collected.

Should you defend a lawsuit if you're judgment proof?

Yes—if you ignore the case, the court may issue a default judgment against you, which can be enforced later if your finances improve.

Can someone remain judgment proof forever?

Usually not. If their income or assets increase in the future, creditors can try to collect on the judgment.

Get Started Today!

24 hours a day / 7 days a week / 365 days a year

Contact our Los Angles and Antelope team of attorneys for a free consultation.